Ronan McGrath , 2025-05-16 07:30:00

In today’s financial landscape, global markets are experiencing notable volatility, writes Ronan McGrath

These are challenging, emotional times for investors, particularly those nearing or in retirement. While several factors contribute to the current turbulence, the primary driver is President Trump’s erratic tariff policy, which has injected fresh instability into the global economy.

Ronan McGrath, Oakwood Financial Advisors

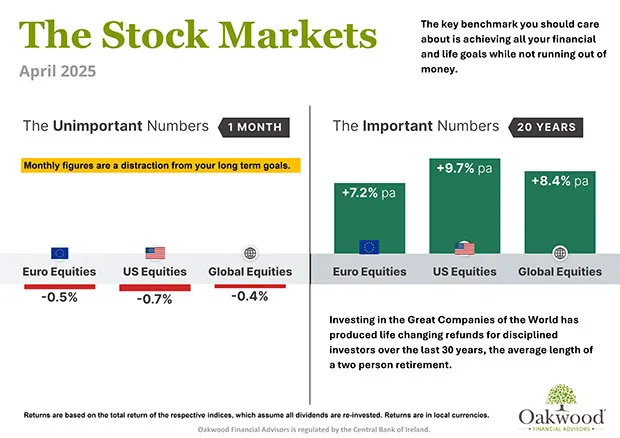

What many investors have missed with all the noise, is that many equity markets outside the US-particularly in Europe and emerging markets – are in positive territory year to date, with European equities recently posting their strongest quarterly performance in decades and emerging markets also delivering gains despite ongoing volatility.

Trump Tariff Reversal

Just days after declaring sweeping new tariffs on “Liberation Day,” President Trump abruptly reversed course. Bowing to pressure from advisors and mounting market backlash, he suspended the new tariffs for 90 days for all countries except China. This sudden policy U-turn, announced on April 9, sparked a dramatic rebound in equities, with the S&P 500 recording its largest single-day gain since 2008 and similar surges in the Dow and Nasdaq.

Such unpredictable policymaking, compounded by threats against Federal Reserve Chair Jerome Powell (head of the US Central Bank) and persistent inflation concerns, has deepened investor anxiety. With investors and businesses alike awaiting clearer policy signals, markets are likely to remain volatile until there is greater clarity from US policymakers. However, the recent US-China talks (May 10th) – initiated by the Trump administration – have yielded signs of substantial progress, prompting cautious optimism that a framework for ongoing dialogue could help stabilise markets.

Emotions Can Lead to Unwise Action

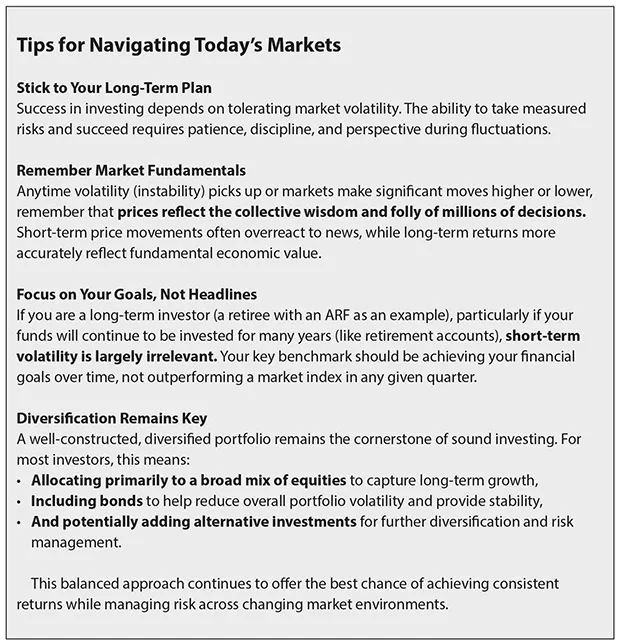

Without doubt, emotions play a significant role in investment decisions. Emotional reactions to market swings (volatility) often lead investors to make poor decisions, such as panic selling during downturns. History shows that maintaining discipline and staying invested through volatility is key to long-term success.

Take the Long-term View and Wisely Hold Your Nerve

Holding firm, once you have invested in line with your long-term strategy, remains the most rational approach. Accurately timing entry into and exit from markets simply doesn’t work consistently. When faced with alarming headlines and short-term market swings, it’s easy to lose sight of the potential long-term benefits of staying invested.

While no one can predict the future with certainty, adopting a long-term perspective can help you view market volatility differently and look beyond sensationalist headlines. Remember that today’s headline-grabbing policies and market reactions will likely be mere footnotes in your long-term investment journey.

Inflation – The Silent Threat to Your Wealth

Inflation remains the greatest long-term threat to your savings. Cash may feel safe, even with Irish inflation currently at 2.1%, its purchasing power quietly erodes over time – especially when inflation outpaces the interest earned on deposits.

The real value of money is measured by its purchasing power, not its nominal amount. If your savings earn 1% interest but inflation is 3%, you are effectively losing 2% in real terms each year. Over time, this “silent theft” can significantly erode your wealth, making it harder to achieve your financial goals.

Market Performance Varies Across Sectors and Styles

Despite negative headlines and broad declines in major U.S. indexes, market performance in 2025 has been far from uniform. While the S&P 500 is down, international equities have outperformed, with the FTSE 100 up over 5%, the FTSE All-World Index (excluding the U.S.) up 7%, and the MSCI World Value Index up nearly 9% year-to-date. Defensive sectors such as energy (+9.3%), health care (+6.1%), and consumer staples (+4.6%) have led within the U.S., while technology and consumer discretionary stocks have lagged significantly.

This divergence reflects investor rotation toward value and defensive stocks, and a growing appetite for global diversification as U.S. policy volatility persists. Companies with robust revenues and strong cash flows have generally shown resilience, while growth stocks – especially large-cap tech-have struggled amid rising rates and tariff uncertainty. The result is a market landscape where select international and value-oriented strategies are providing relative stability and opportunity, even as U.S. benchmarks remain under pressure.

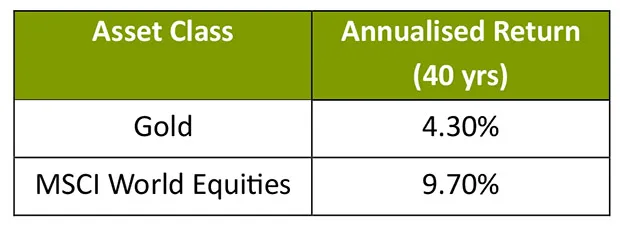

Is Gold Overvalued?

Gold’s 2025 rally (a new record high of over $3,240) reflects extraordinary global uncertainty and demand for safety, not just speculative excess. While it may appear expensive by historical standards, most forecasts suggest the drivers of high prices remain in place for now. However, gold’s long-term returns have often lagged equities (company shares, especially when factoring in dividends, and its history of volatility and drawdowns (45% drop between 2011 – 2015) means it remains a challenging asset for investors.

For most, gold is best used as a tactical hedge within a diversified portfolio, not as a core long-term holding.

Growth Assets for Wealth Protection

Growth-oriented assets like equities and property provide inflation-plus returns over the long term, protecting wealth value. Equities though unlike property provides easy access and liquidity. A well-diversified portfolio with significant equity exposure has historically been the best protection against inflation. This is particularly important given that current global inflation expectations are now at 4% for 2025.

Opportunities Exist for Those Who Look Beyond Headlines

Despite negative news cycles, significant opportunities exist in today’s markets. The current volatility has created attractive entry points in many quality assets. Selective international equity markets present opportunities and also for diversification. Current volatility has created attractive entry points in quality assets, with equity valuations in sectors like Europe being attractive.

Summary: Patience and Perspective Are Your Best Allies

History has repeatedly shown that patient, disciplined investors who stay the course through market volatility are usually rewarded. The best defence against uncertainty is to stick to your plan – remain invested in a well-diversified portfolio tailored to your goals and time horizon.

Remember that today’s headlines – whether about tariffs, interest rates, the price of eggs (one of Trumps favourites before last November’s election but not so much now) or inflation concerns – will eventually fade. Investing in quality assets such as equities remains consistent through market cycles. By focusing on your long-term objectives rather than reacting to short-term noise, you position yourself for financial success regardless of current market conditions. ![]()

Information

Oakwood Financial Advisors are specialist financial advisors to the medical profession, with a unique understanding of both the GMS Pension Scheme and also the Health Service Executive pension benefits.

For more information please contact Ronan at: ronan@oakwoodfinancial.ie or on 086 609 8615.

Oakwood Financial Advisors is regulated by the Central Bank of Ireland and only recommends regulated investment products.

Visit: https://www.oakwoodfinancial.ie/publications/

This has been an advertorial fature on behalf of Oakwood Financial Advusors.